iShares Nikkei 225 UCITS (DE) (EXX7) - Stock & Dividends

Exchange: XETRA Stock Exchange • Country: Germany • Currency: EUR • Type: Etf • ISIN: DE000A0H08D2 • Japan Large-Cap Equity

The iShares Nikkei 225 UCITS ETF (DE) is an exchange-traded fund (ETF) that tracks the performance of the Japanese stock market. Listed on the XETRA stock exchange under the ticker symbol EXX7, this ETF provides investors with a convenient way to gain exposure to the Japanese market.

The ETF is domiciled in Germany, which means it is regulated by the German financial authorities and adheres to European Union regulations. This provides an added layer of security and transparency for investors.

The ETF tracks the Morningstar Japan TME NR JPY index, which is a widely followed benchmark that measures the performance of the Japanese equity market. This index is designed to provide a comprehensive view of the Japanese stock market, covering a broad range of sectors and companies.

By investing in the iShares Nikkei 225 UCITS ETF (DE), investors can gain exposure to some of Japan's largest and most influential companies, including those in the technology, automotive, and financial sectors. This can provide a valuable diversification benefit for investors seeking to reduce their exposure to any one particular market or sector.

The ETF is managed by iShares, a leading global provider of ETFs, which has a strong reputation for providing investors with low-cost, flexible, and transparent investment solutions. You can learn more about the ETF and its investment strategy by visiting the iShares website at http://www.iShares.de.

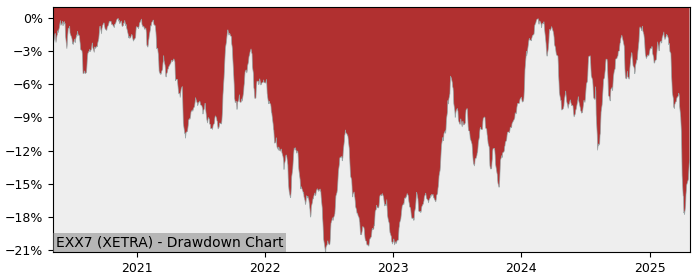

Drawdown (Underwater) Chart

EXX7 ETF Overview

| Market Cap in USD | 30,408m |

| Category | Japan Large-Cap Equity |

| TER | 0.00% |

| IPO / Inception | 2006-07-05 |

EXX7 ETF Ratings

| Growth 5y | 3.87 |

| Fundamental | - |

| Dividend | 5.19 |

| Rel. Performance vs Sector | -0.45 |

| Analysts | - |

| Fair Price Momentum | 20.67 EUR |

| Fair Price DCF | - |

EXX7 Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 2.96% |

| Payout Consistency | 87.1% |

EXX7 Growth Ratios

| Growth 12m | 10.84% |

| Growth Correlation 12m | 42% |

| Growth Correlation 3m | -43% |

| CAGR 5y | 6.77% |

| CAGR/Mean DD 5y | 0.77 |

| Sharpe Ratio 12m | 0.36 |

| Alpha vs SP500 12m | -8.39 |

| Beta vs SP500 5y weekly | 0.61 |

| ValueRay RSI | 30.68 |

| Volatility GJR Garch 1y | 15.14% |

| Price / SMA 50 | -3.12% |

| Price / SMA 200 | 5.18% |

| Current Volume | 11.4k |

| Average Volume 20d | 8.3k |

External Links for EXX7 ETF

As of May 20, 2024, the stock is trading at EUR 22.96 with a total of 11,446 shares traded.

Over the past week, the price has changed by +1.06%, over one month by +0.88%, over three months by -3.57% and over the past year by +10.73%.

According to ValueRays Forecast Model, EXX7 iShares Nikkei 225 UCITS (DE) will be worth about 22.8 in May 2025. The stock is currently trading at 22.96. This means that the stock has a potential downside of -0.61%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 22.8 | -0.61 |