Xtrackers - DAX UCITS (DBXD) - Stock & Dividends

Exchange: XETRA Stock Exchange • Country: Germany • Currency: EUR • Type: Etf • ISIN: LU0274211480 • Germany Equity

The Xtrackers - DAX UCITS ETF is an exchange-traded fund (ETF) that tracks the performance of the Morningstar Germany TME NR EUR index. This means it's designed to replicate the performance of the German stock market, giving investors exposure to some of Germany's largest and most successful companies.

As a UCITS-compliant ETF, it's authorized to be sold in the European Union and is subject to strict regulations, ensuring a high level of investor protection. The fund is domiciled in Luxembourg, a well-established hub for investment funds in Europe.

The ETF is managed by DWS, a global asset manager with a long history of providing investment solutions to individual and institutional investors. You can find more information about the fund and its manager on the DWS website, which is accessible at http://www.dws.lu.

By investing in the Xtrackers - DAX UCITS ETF, you'll gain diversified exposure to the German stock market, which is home to many world-leading companies in industries such as automotive, technology, and healthcare. This can be an attractive option for investors seeking to tap into the growth potential of the German economy.

As the ETF is listed on the XETRA stock exchange under the ticker symbol DBXD, investors can easily buy and sell shares throughout the trading day, providing flexibility and liquidity.

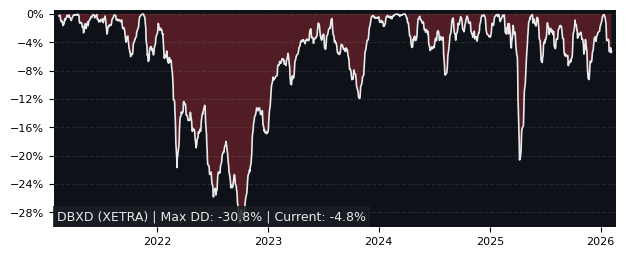

Drawdown (Underwater) Chart

DBXD ETF Overview

| Market Cap in USD | 4,703m |

| Category | Germany Equity |

| TER | 0.09% |

| IPO / Inception | 2007-01-10 |

DBXD ETF Ratings

| Growth 5y | 5.65 |

| Fundamental | - |

| Dividend | - |

| Rel. Performance vs Sector | -0.65 |

| Analysts | - |

| Fair Price Momentum | 167.23 EUR |

| Fair Price DCF | - |

DBXD Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

DBXD Growth Ratios

| Growth 12m | 17.87% |

| Growth Correlation 12m | 53% |

| Growth Correlation 3m | 57% |

| CAGR 5y | 8.57% |

| CAGR/Mean DD 5y | 1.27 |

| Sharpe Ratio 12m | 1.12 |

| Alpha vs SP500 12m | -7.23 |

| Beta vs SP500 5y weekly | 0.86 |

| ValueRay RSI | 70.54 |

| Volatility GJR Garch 1y | 11.42% |

| Price / SMA 50 | 2.73% |

| Price / SMA 200 | 12.12% |

| Current Volume | 15.6k |

| Average Volume 20d | 33k |

External Links for DBXD ETF

As of May 20, 2024, the stock is trading at EUR 176.26 with a total of 15,624 shares traded.

Over the past week, the price has changed by -0.24%, over one month by +5.15%, over three months by +9.10% and over the past year by +14.38%.

According to ValueRays Forecast Model, DBXD Xtrackers - DAX UCITS will be worth about 185.8 in May 2025. The stock is currently trading at 176.26. This means that the stock has a potential upside of +5.42%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 185.8 | 5.42 |