Arbonia AG (ARBN) - Stock Price & Dividends

Exchange: SIX Swiss Exchange • Country: Switzerland • Currency: CHF • Type: Common Stock • ISIN: CH0110240600

Arbonia AG is a leading provider of innovative building components, operating in Switzerland, Germany, and internationally. The company's product portfolio is divided into two main categories: Climate and Doors.

The Climate division offers a wide range of products, including steel panel radiators, glass wall systems, special radiators, ventilation units, design radiators, heat pumps, air heaters, radiant panels, underfloor heating systems, fan coils, storage batteries, central air conditioners, air and unit heaters, heat recovery, filter technology, evaporative coolers, and air handling units. These products are designed to provide comfortable and sustainable indoor climates.

In addition to its Climate division, Arbonia AG also offers a variety of door solutions through its Doors division. This includes construction glass, shower stalls, interior doors and frames, shower enclosures, underfloor convectors, functional doors, glass systems, acrylic/mineral cast bathtubs and shower trays, door frames, and door trims. These products are designed to provide functionality, style, and safety in buildings.

Arbonia AG markets its products under a range of well-known brand names, including Arbonia, Baduscho, Interwand, Joro, Brugman, Cicsa, Cirelius, Garant, Invado, Kermi, Koralle, Prolux, Prüm, RWD Schlatter, Sabiana, Superia, Termovent, Tecna, and Vasco. This diverse brand portfolio enables the company to cater to a wide range of customer needs and preferences.

With a rich history dating back to 1874, Arbonia AG has established itself as a trusted partner for builders, architects, and homeowners. The company's commitment to innovation, quality, and customer satisfaction has earned it a reputation as a leading provider of building components. Headquartered in Arbon, Switzerland, Arbonia AG continues to drive growth and innovation in the building industry.

For more information about Arbonia AG and its products, please visit their website at https://www.arbonia.com/de/.

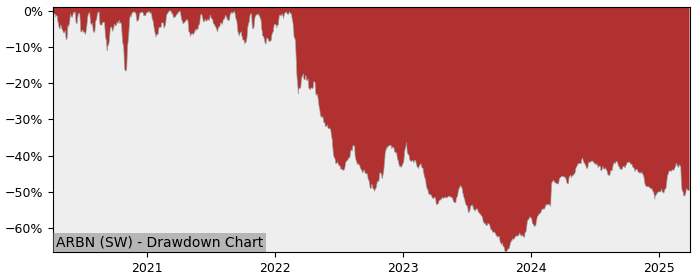

Drawdown (Underwater) Chart

ARBN Stock Overview

| Market Cap in USD | 887m |

| Sector | Industrials |

| Industry | Building Products & Equipment |

| GiC SubIndustry | Building Products |

| TER | 0.00% |

| IPO / Inception |

ARBN Stock Ratings

| Growth 5y | 0.86 |

| Fundamental | 2.61 |

| Dividend | 0.83 |

| Rel. Performance vs Sector | 0.02 |

| Analysts | - |

| Fair Price Momentum | 11.74 CHF |

| Fair Price DCF | 3.59 CHF |

ARBN Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | -5.59% |

| Payout Consistency | 41.8% |

ARBN Growth Ratios

| Growth 12m | 19.78% |

| Growth Correlation 12m | 22% |

| Growth Correlation 3m | 54% |

| CAGR 5y | 3.72% |

| CAGR/Mean DD 5y | 0.14 |

| Sharpe Ratio 12m | 0.40 |

| Alpha vs SP500 12m | -7.79 |

| Beta vs SP500 5y weekly | 0.97 |

| ValueRay RSI | 79.42 |

| Volatility GJR Garch 1y | 27.34% |

| Price / SMA 50 | 6.91% |

| Price / SMA 200 | 31.96% |

| Current Volume | 81.7k |

| Average Volume 20d | 172k |

External Links for ARBN Stock

As of May 19, 2024, the stock is trading at CHF 12.84 with a total of 81,735 shares traded.

Over the past week, the price has changed by +0.63%, over one month by +10.12%, over three months by +23.94% and over the past year by +20.90%.

According to ValueRays Forecast Model, ARBN Arbonia AG will be worth about 12.9 in May 2025. The stock is currently trading at 12.84. This means that the stock has a potential upside of +0.78%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 11.4 | -11.3 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 12.9 | 0.78 |