Cheniere Energy Partners LP (CQP) - Stock & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US16411Q1013

Cheniere Energy Partners, L.P. is a leading player in the global energy market, specializing in the production and supply of liquefied natural gas (LNG) to a diverse range of customers worldwide, including integrated energy companies, utilities, and energy trading companies.

The company's crown jewel is its natural gas liquefaction and export facility located at the Sabine Pass LNG Terminal in Cameron Parish, Louisiana. This state-of-the-art facility is strategically positioned to capitalize on the growing demand for clean energy, and is capable of producing large quantities of LNG for export to markets around the world.

In addition to its liquefaction facility, Cheniere Energy Partners also owns and operates a natural gas supply pipeline that connects the Sabine Pass LNG terminal to various interstate pipelines. This pipeline provides a critical link between the company's LNG production facility and the broader natural gas transportation network, enabling the efficient and reliable delivery of LNG to customers.

Founded in 2003, Cheniere Energy Partners is headquartered in Houston, Texas, and is a subsidiary of Cheniere Energy, Inc. With a strong track record of operational excellence and a commitment to safety and sustainability, the company is well-positioned to continue playing a key role in the global energy landscape for years to come.

For more information about Cheniere Energy Partners, L.P., please visit their website at https://cqpir.cheniere.com.

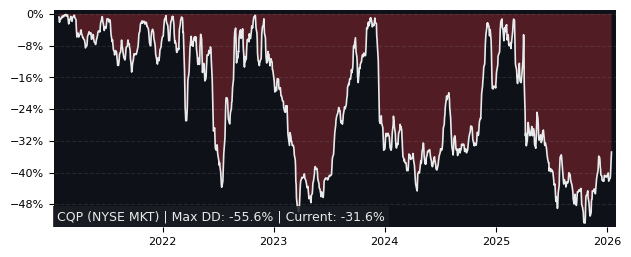

Drawdown (Underwater) Chart

CQP Stock Overview

| Market Cap in USD | 23,282m |

| Sector | Energy |

| Industry | Oil & Gas Midstream |

| GiC SubIndustry | Oil & Gas Storage & Transportation |

| TER | 0.00% |

| IPO / Inception | 2007-03-21 |

CQP Stock Ratings

| Growth 5y | 4.94 |

| Fundamental | 43.8 |

| Dividend | 9.93 |

| Rel. Performance vs Sector | -1.42 |

| Analysts | 2.29/5 |

| Fair Price Momentum | 55.92 USD |

| Fair Price DCF | 156.51 USD |

CQP Dividends

| Yield 12m | 7.89% |

| Yield on Cost 5y | 13.05% |

| Dividends CAGR 5y | 11.50% |

| Payout Consistency | 98.7% |

CQP Growth Ratios

| Growth 12m | 15.29% |

| Growth Correlation 12m | 18% |

| Growth Correlation 3m | -13% |

| CAGR 5y | 10.58% |

| CAGR/Mean DD 5y | 0.83 |

| Sharpe Ratio 12m | 0.37 |

| Alpha vs SP500 12m | -6.56 |

| Beta vs SP500 5y weekly | 0.72 |

| ValueRay RSI | 57.45 |

| Volatility GJR Garch 1y | 32.35% |

| Price / SMA 50 | 3.04% |

| Price / SMA 200 | -2% |

| Current Volume | 205.7k |

| Average Volume 20d | 196.4k |

External Links for CQP Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 19, 2024, the stock is trading at USD 49.52 with a total of 205,735 shares traded.

Over the past week, the price has changed by +4.03%, over one month by +7.86%, over three months by -3.26% and over the past year by +13.57%.

According to ValueRays Forecast Model, CQP Cheniere Energy Partners LP will be worth about 60.4 in May 2025. The stock is currently trading at 49.52. This means that the stock has a potential upside of +21.97%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 49.4 | -0.20 |

| Analysts Target Price | 49.7 | 0.38 |

| ValueRay Target Price | 60.4 | 22.0 |