Technology Sector SPDR Fund (XLK) - Stock & Dividends

Exchange: USA Stocks • Country: USA • Currency: USD • Type: Etf • ISIN: US81369Y8030 • Technology

The Technology Select Sector SPDR Fund, listed on the NYSE ARCA under the ticker symbol XLK, is an exchange-traded fund (ETF) designed to track the performance of a specific index. To achieve this, the fund uses a replication strategy, which involves investing in almost all the securities that make up the index, in roughly the same proportions as the index.

This means that the fund typically allocates at least 95% of its total assets to the securities that comprise the index. This approach allows investors to gain exposure to the technology sector as a whole, rather than trying to pick individual winners or losers.

As a non-diversified fund, the Technology Select Sector SPDR Fund is focused on a specific sector, which can be beneficial for investors who want to target a particular area of the market. The fund is based in the United States and provides investors with a convenient way to tap into the technology sector, which is a key driver of innovation and growth in the global economy.

For more information about the fund, investors can visit the website of the fund's provider, which can be found at http://www.spdrs.com. This website offers a range of resources and tools to help investors make informed decisions about their investments.

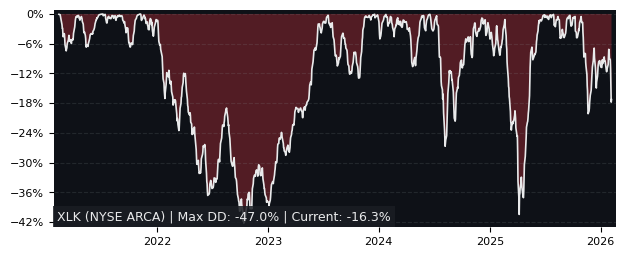

Drawdown (Underwater) Chart

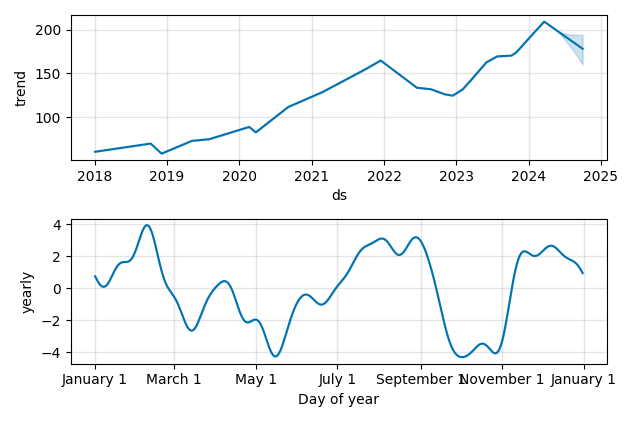

Overall Trend and Yearly Seasonality

XLK ETF Overview

| Market Cap in USD | 63,334m |

| Category | Technology |

| TER | 0.09% |

| IPO / Inception | 1998-12-16 |

XLK ETF Ratings

| Growth 5y | 8.59 |

| Fundamental | - |

| Dividend | 6.53 |

| Rel. Performance vs Sector | 0.64 |

| Analysts | - |

| Fair Price Momentum | 224.96 USD |

| Fair Price DCF | - |

XLK Dividends

| Yield 12m | 0.70% |

| Yield on Cost 5y | 2.10% |

| Dividends CAGR 5y | 6.62% |

| Payout Consistency | 88.6% |

XLK Growth Ratios

| Growth 12m | 35.60% |

| Growth Correlation 12m | 65% |

| Growth Correlation 3m | -15% |

| CAGR 5y | 24.54% |

| CAGR/Mean DD 5y | 3.06 |

| Sharpe Ratio 12m | 1.70 |

| Alpha vs SP500 12m | 3.97 |

| Beta vs SP500 5y weekly | 1.14 |

| ValueRay RSI | 75.56 |

| Volatility GJR Garch 1y | 18.06% |

| Price / SMA 50 | 3.49% |

| Price / SMA 200 | 12.94% |

| Current Volume | 3771.7k |

| Average Volume 20d | 5492.5k |

External Links for XLK ETF

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 20, 2024, the stock is trading at USD 211.82 with a total of 3,771,704 shares traded.

Over the past week, the price has changed by +2.57%, over one month by +10.02%, over three months by +5.82% and over the past year by +35.60%.

According to ValueRays Forecast Model, XLK Technology Sector SPDR Fund will be worth about 251.7 in May 2025. The stock is currently trading at 211.82. This means that the stock has a potential upside of +18.84%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 251.7 | 18.8 |