Industrial Sector SPDR Fund (XLI) - Stock & Dividends

Exchange: USA Stocks • Country: USA • Currency: USD • Type: Etf • ISIN: US81369Y7040 • Industrials

The Industrial Select Sector SPDR Fund is an investment fund that typically puts most of its assets, at least 95%, into securities that make up a specific index. This index is made up of companies that operate in the industrial sector, as classified by the Global Industry Classification Standard.

These industrial companies come from a range of industries, including aerospace and defense, industrial conglomerates, and marine transportation. This means the fund is invested in companies that manufacture and provide goods and services related to these areas, such as aircraft, defense systems, industrial machinery, and shipping.

It's worth noting that the fund is considered non-diversified, which means it can invest a significant portion of its assets in a single industry or sector. This can be beneficial if that sector performs well, but it also increases the risk if that sector experiences a downturn.

The fund is managed in the United States and provides investors with a way to gain exposure to the industrial sector of the US stock market. For more information, you can visit the fund's website at http://www.spdrs.com.

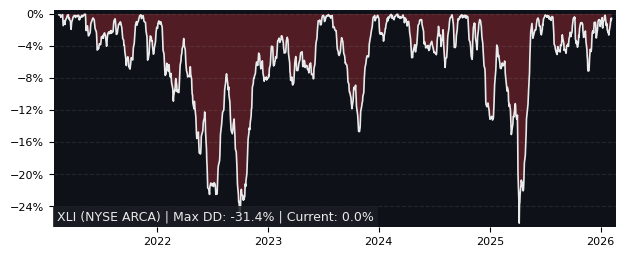

Drawdown (Underwater) Chart

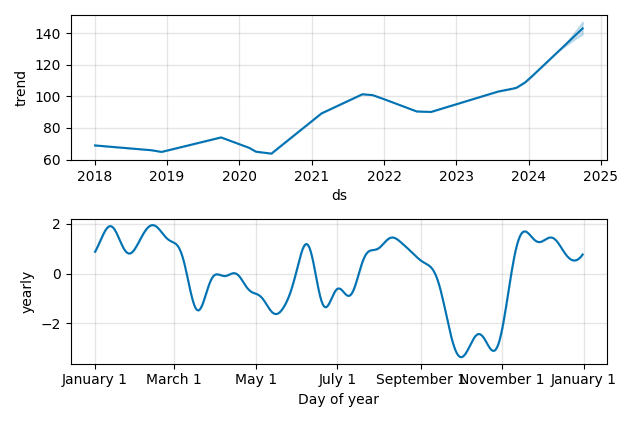

Overall Trend and Yearly Seasonality

XLI ETF Overview

| Market Cap in USD | 18,128m |

| Category | Industrials |

| TER | 0.09% |

| IPO / Inception | 1998-12-16 |

XLI ETF Ratings

| Growth 5y | 7.70 |

| Fundamental | - |

| Dividend | 6.30 |

| Rel. Performance vs Sector | -0.04 |

| Analysts | - |

| Fair Price Momentum | 124.04 USD |

| Fair Price DCF | - |

XLI Dividends

| Yield 12m | 1.47% |

| Yield on Cost 5y | 2.68% |

| Dividends CAGR 5y | 3.23% |

| Payout Consistency | 96.5% |

XLI Growth Ratios

| Growth 12m | 27.71% |

| Growth Correlation 12m | 63% |

| Growth Correlation 3m | 42% |

| CAGR 5y | 12.80% |

| CAGR/Mean DD 5y | 2.16 |

| Sharpe Ratio 12m | 1.79 |

| Alpha vs SP500 12m | -1.71 |

| Beta vs SP500 5y weekly | 1.05 |

| ValueRay RSI | 47.33 |

| Volatility GJR Garch 1y | 11.99% |

| Price / SMA 50 | 1.47% |

| Price / SMA 200 | 12.19% |

| Current Volume | 5625.8k |

| Average Volume 20d | 8477.7k |

External Links for XLI ETF

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 20, 2024, the stock is trading at USD 125.33 with a total of 5,625,845 shares traded.

Over the past week, the price has changed by +0.14%, over one month by +4.03%, over three months by +6.85% and over the past year by +27.71%.

According to ValueRays Forecast Model, XLI Industrial Sector SPDR Fund will be worth about 138.5 in May 2025. The stock is currently trading at 125.33. This means that the stock has a potential upside of +10.49%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 138.5 | 10.5 |