Understanding SPDR S&P 500 ETF Trust (SPY): A Glimpse Into Its History, Core Business, and Market Presence

The History and Evolution of SPDR S&P 500 ETF Trust

Since its launch in January 1993, the SPDR S&P 500 ETF Trust (NYSE ARCA: SPY) has been a trailblazer in the investment world. It was the very first exchange-traded fund (ETF) listed in the United States, creating a new way for investors to gain exposure to the S&P 500, a benchmark index representing the U.S. stock market performance. This innovation has made it easier for individual and institutional investors to invest in a wide section of the U.S. economy through purchasing a single ETF.

Core and Side Businesses of SPDR S&P 500 ETF Trust

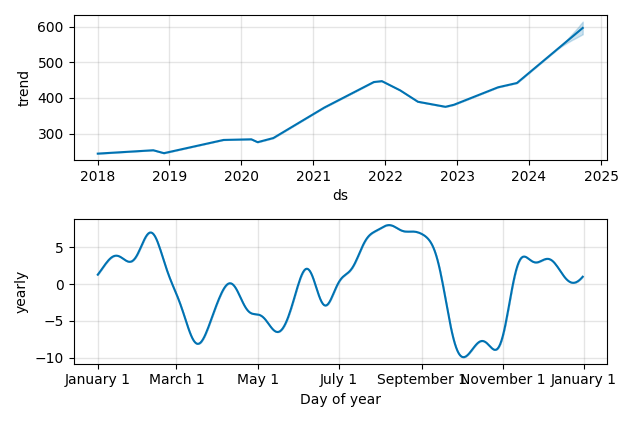

The main business of SPDR S&P 500 ETF Trust revolves around tracking the performance of the S&P 500 Index. It is designed to provide investors with investment results that, before expenses, generally correspond to the price and yield performance of the S&P 500 Index. Through owning a broad and diversified set of companies, SPY enables investors to gain exposure to the U.S. equity market. While SPY's core focus remains on tracking the S&P 500, its involvement in derivatives and securities lending are side activities that aim to enhance its performance and match its targeted index as closely as possible.

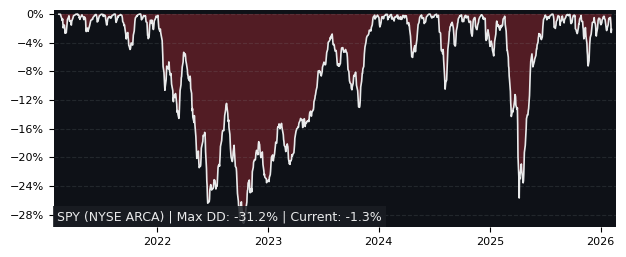

Current Market Status of SPDR S&P 500 ETF Trust

In recent years, SPDR S&P 500 ETF Trust has continued to be a dominant force in the ETF market. As of my last knowledge update in April 2023, it remains one of the largest ETFs in the world by assets under management. Its popularity stems from its broad market exposure, liquidity, and relatively low cost. Market conditions constantly fluctuate, affecting its price and performance. However, its historical resilience and role as a core investment tool for both individual and professional investors signify its continued importance in the investment landscape.