iShares Silver Trust (SLV) - Stock & Dividends

Exchange: USA Stocks • Country: USA • Currency: USD • Type: Etf • ISIN: US46428Q1094 • Commodities Focused

The iShares Silver Trust, listed on the NYSE ARCA under the ticker symbol SLV, aims to track the performance of silver prices, minus the Trust's expenses and liabilities. This means that the Trust's value will fluctuate based on the price of silver, without any attempt to profit from or mitigate losses due to changes in silver prices.

As a passive investment vehicle, the Trust does not employ active management strategies to boost returns or hedge against potential losses. Instead, it provides a straightforward way for investors to gain exposure to the silver market, allowing them to benefit from any potential price increases or hedge against potential declines.

Headquartered in the United States, the Trust is part of the iShares family of exchange-traded funds (ETFs), which are managed by BlackRock, a leading global investment management company. For more information, investors can visit the iShares website at http://www.ishares.com.

By investing in the iShares Silver Trust, investors can add silver to their portfolios, which can help diversify their holdings and potentially reduce risk. With its straightforward investment approach and transparent structure, the Trust provides a convenient way to tap into the silver market, making it an attractive option for investors seeking to gain exposure to this precious metal.

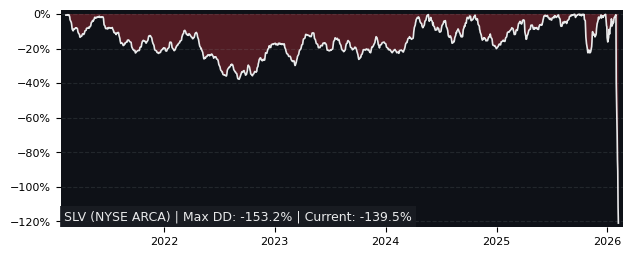

Drawdown (Underwater) Chart

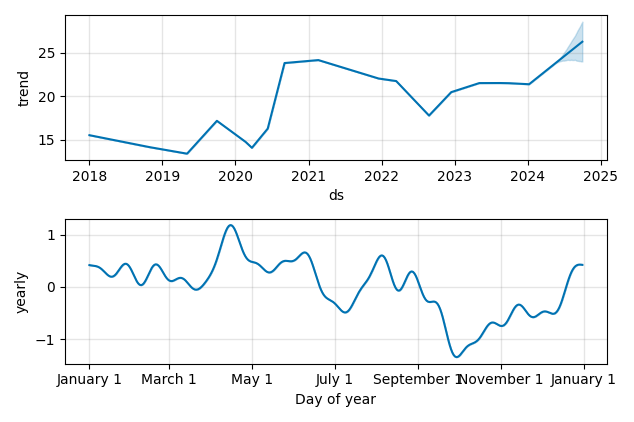

Overall Trend and Yearly Seasonality

SLV ETF Overview

| Market Cap in USD | 11,137m |

| Category | Commodities Focused |

| TER | 0.50% |

| IPO / Inception | 2006-04-21 |

SLV ETF Ratings

| Growth 5y | 4.37 |

| Fundamental | - |

| Dividend | - |

| Rel. Performance vs Sector | 0.29 |

| Analysts | - |

| Fair Price Momentum | 27.33 USD |

| Fair Price DCF | - |

SLV Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

SLV Growth Ratios

| Growth 12m | 31.70% |

| Growth Correlation 12m | 22% |

| Growth Correlation 3m | 69% |

| CAGR 5y | 16.37% |

| CAGR/Mean DD 5y | 1.00 |

| Sharpe Ratio 12m | 1.02 |

| Alpha vs SP500 12m | 15.78 |

| Beta vs SP500 5y weekly | 0.46 |

| ValueRay RSI | 99.76 |

| Volatility GJR Garch 1y | 32.80% |

| Price / SMA 50 | 17.32% |

| Price / SMA 200 | 30.69% |

| Current Volume | 51656.5k |

| Average Volume 20d | 28386.1k |

External Links for SLV ETF

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 20, 2024, the stock is trading at USD 28.79 with a total of 51,656,522 shares traded.

Over the past week, the price has changed by +11.59%, over one month by +9.89%, over three months by +36.64% and over the past year by +31.70%.

According to ValueRays Forecast Model, SLV iShares Silver Trust will be worth about 30.1 in May 2025. The stock is currently trading at 28.79. This means that the stock has a potential upside of +4.41%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 30.1 | 4.41 |