iShares High Yield Corporate Bond (HYG)

Exchange: USA Stocks • Country: USA • Currency: USD • Type: Etf • ISIN: US4642885135 • High Yield Bond

The iShares iBoxx $ High Yield Corporate Bond ETF (NYSE ARCA:HYG) tracks a specific set of high-yield corporate bonds, which are debt securities issued by companies with lower credit ratings. These bonds offer higher yields to compensate for the increased credit risk.

The ETF's underlying index is a rules-based index, meaning it follows a strict set of guidelines to select the bonds that make up the portfolio. This index consists of U.S. dollar-denominated high-yield corporate bonds that are publicly traded in the United States.

The fund's investment strategy is designed to closely track the performance of the underlying index. To achieve this, the fund will invest at least 80% of its assets in the same bonds that make up the index. Additionally, the fund will invest at least 90% of its assets in fixed-income securities that are similar to those in the index, as chosen by the fund's advisor.

By investing in the iShares iBoxx $ High Yield Corporate Bond ETF, you'll gain exposure to a diversified portfolio of high-yield corporate bonds, which can provide a regular income stream and the potential for capital appreciation.

The fund is managed by BlackRock, a leading global investment manager, and is listed on the NYSE Arca exchange under the ticker symbol HYG. For more information, you can visit the iShares website at http://www.ishares.com.

The fund is domiciled in the United States, which means it is subject to U.S. regulations and tax laws. This can impact the fund's performance and the taxes you may owe on any capital gains or income earned from your investment.

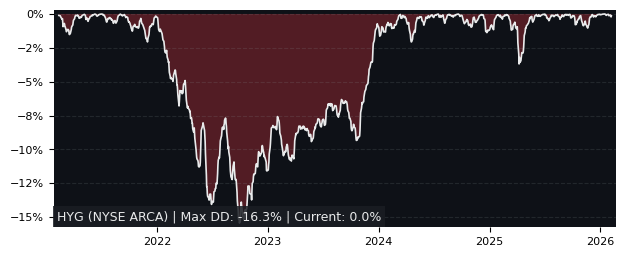

Drawdown (Underwater) Chart

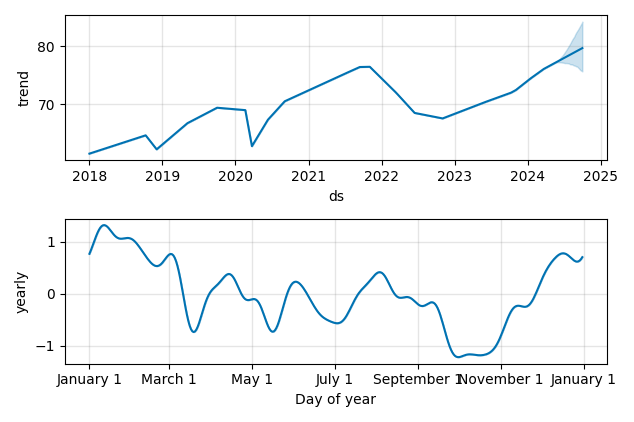

Overall Trend and Yearly Seasonality

HYG ETF Overview

| Market Cap in USD | 14,922m |

| Category | High Yield Bond |

| TER | 0.49% |

| IPO / Inception | 2007-04-04 |

HYG ETF Ratings

| Growth 5y | 3.66 |

| Fundamental | - |

| Dividend | 6.72 |

| Rel. Performance vs Sector | -1.51 |

| Analysts | - |

| Fair Price Momentum | 71.78 USD |

| Fair Price DCF | - |

HYG Dividends

| Yield 12m | 5.92% |

| Yield on Cost 5y | 6.88% |

| Dividends CAGR 5y | 0.24% |

| Payout Consistency | 92.6% |

HYG Growth Ratios

| Growth 12m | 10.67% |

| Growth Correlation 12m | 70% |

| Growth Correlation 3m | 27% |

| CAGR 5y | 3.04% |

| CAGR/Mean DD 5y | 0.72 |

| Sharpe Ratio 12m | 0.89 |

| Alpha vs SP500 12m | -5.88 |

| Beta vs SP500 5y weekly | 0.49 |

| ValueRay RSI | 66.47 |

| Volatility GJR Garch 1y | 5.09% |

| Price / SMA 50 | 0.99% |

| Price / SMA 200 | 4.45% |

| Current Volume | 30800.2k |

| Average Volume 20d | 37513.8k |

External Links for HYG ETF

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 20, 2024, the stock is trading at USD 77.28 with a total of 30,800,169 shares traded.

Over the past week, the price has changed by +0.52%, over one month by +2.25%, over three months by +1.90% and over the past year by +10.67%.

According to ValueRays Forecast Model, HYG iShares High Yield Corporate Bond will be worth about 79 in May 2025. The stock is currently trading at 77.28. This means that the stock has a potential upside of +2.24%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 79 | 2.24 |