iShares MSCI Brazil (EWZ) - Stock Price & Dividends

Exchange: USA Stocks • Country: USA • Currency: USD • Type: Etf • ISIN: US4642864007 • Latin America Stock

The iShares MSCI Brazil ETF (NYSE ARCA: EWZ) is an exchange-traded fund that focuses on investing in Brazilian companies. Specifically, it puts at least 80% of its assets into stocks that make up its underlying index, as well as other investments that closely resemble those stocks.

The underlying index is a special kind of index that measures the performance of large and mid-sized companies in Brazil. It's called a free float-adjusted market capitalization-weighted index, which means it takes into account the size of each company and how easily its shares can be bought and sold.

As a non-diversified fund, the iShares MSCI Brazil ETF concentrates its investments in a specific area, in this case, the Brazilian market. This allows investors to target a particular region and sector, but it also means the fund may be more vulnerable to market fluctuations.

The fund is managed by BlackRock, a global investment company, and is listed on the NYSE Arca exchange under the ticker symbol EWZ. You can find more information about the fund on the iShares website at http://www.ishares.com. The fund is domiciled in the United States.

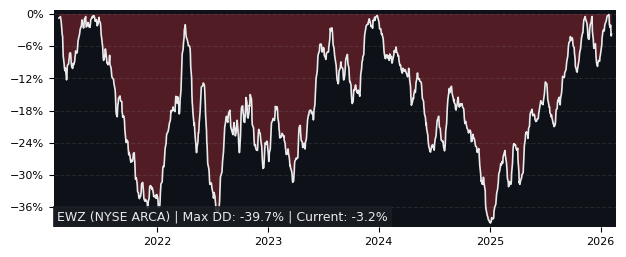

Drawdown (Underwater) Chart

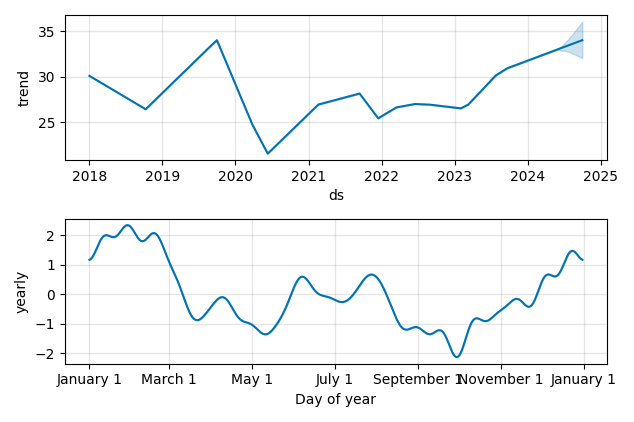

Overall Trend and Yearly Seasonality

EWZ ETF Overview

| Market Cap in USD | 4,848m |

| Category | Latin America Stock |

| TER | 0.59% |

| IPO / Inception | 2000-07-10 |

EWZ ETF Ratings

| Growth 5y | 1.46 |

| Fundamental | - |

| Dividend | 8.94 |

| Rel. Performance vs Sector | -1.35 |

| Analysts | - |

| Fair Price Momentum | 28.77 USD |

| Fair Price DCF | - |

EWZ Dividends

| Yield 12m | 6.23% |

| Yield on Cost 5y | 7.16% |

| Dividends CAGR 5y | 19.77% |

| Payout Consistency | 87.4% |

EWZ Growth Ratios

| Growth 12m | 12.71% |

| Growth Correlation 12m | 29% |

| Growth Correlation 3m | -54% |

| CAGR 5y | 2.82% |

| CAGR/Mean DD 5y | 0.12 |

| Sharpe Ratio 12m | 0.34 |

| Alpha vs SP500 12m | -17.81 |

| Beta vs SP500 5y weekly | 1.10 |

| ValueRay RSI | 44.70 |

| Volatility GJR Garch 1y | 23.42% |

| Price / SMA 50 | -0.19% |

| Price / SMA 200 | 0.13% |

| Current Volume | 13348k |

| Average Volume 20d | 17337.8k |

External Links for EWZ ETF

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 20, 2024, the stock is trading at USD 31.75 with a total of 13,347,983 shares traded.

Over the past week, the price has changed by -0.09%, over one month by +3.29%, over three months by -5.76% and over the past year by +12.71%.

According to ValueRays Forecast Model, EWZ iShares MSCI Brazil will be worth about 32.2 in May 2025. The stock is currently trading at 31.75. This means that the stock has a potential upside of +1.29%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 32.2 | 1.29 |