ResMed (RMD) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US7611521078

ResMed Inc., traded as NYSE:RMD, is a company focusing on developing, creating, distributing, and promoting medical devices and cloud-based software applications tailored for the healthcare sector. The company operates within two main segments: Sleep and Respiratory Care, along with Software as a Service. Providing a wide array of products and solutions for numerous respiratory disorders, ResMed offers advanced technologies for medical and consumer products, ventilation devices, diagnostic tools, mask systems suitable for both hospital and home use, headgear and various accessories, dental devices, and cloud-based software informatics aimed at managing patient outcomes and enhancing customer and business processes.

In addition to its core offerings, ResMed provides a range of innovative products such as AirView, a cloud-based system facilitating remote monitoring and adjustment of patients' device settings; myAir, a personalized therapy management app designed for patients dealing with sleep apnea, delivering support, educational resources, and troubleshooting tools to boost patient engagement and adherence. Moreover, the company offers solutions like U-Sleep, a compliance monitoring tool that helps home medical equipment (HME) providers streamline their sleep programs; connectivity modules, and Propeller portal, among others.

Furthermore, ResMed extends its services with out-of-hospital software solutions such as Brightree business management software catering to HME providers, pharmacies, home infusion services, orthotics, and prosthetics; MatrixCare care management solutions for senior living, skilled nursing, life plan communities, home health, home care, hospice organizations, and related accountable care organizations; HEALTHCAREfirst electronic health record software, billing and coding services, and analytics for home health and hospice agencies; as well as MEDIFOX DAN's software solutions.

With its headquarters in San Diego, California, ResMed Inc. was established in 1989. The company reaches out to sleep clinics, home healthcare dealers, and hospitals through a network of distributors and a competent direct sales force. For more information, you can visit their website at https://www.resmed.com.

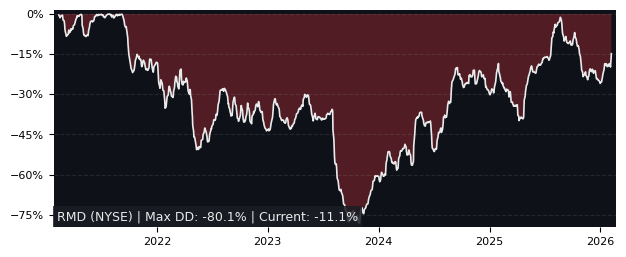

Drawdown (Underwater) Chart

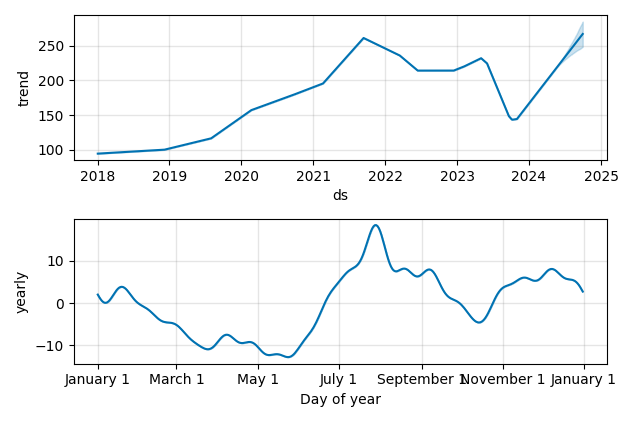

Overall Trend and Yearly Seasonality

RMD Stock Overview

| Market Cap in USD | 27,032m |

| Sector | Healthcare |

| Industry | Medical Instruments & Supplies |

| GiC SubIndustry | Health Care Equipment |

| TER | 0.00% |

| IPO / Inception | 1995-06-02 |

RMD Stock Ratings

| Growth 5y | 4.07 |

| Fundamental | 76.8 |

| Dividend | 6.29 |

| Rel. Performance vs Sector | -1.78 |

| Analysts | 4.00/5 |

| Fair Price Momentum | 204.49 USD |

| Fair Price DCF | 179.44 USD |

RMD Dividends

| Yield 12m | 0.86% |

| Yield on Cost 5y | 1.91% |

| Dividends CAGR 5y | 3.90% |

| Payout Consistency | 100.0% |

RMD Growth Ratios

| Growth 12m | -8.57% |

| Growth Correlation 12m | -12% |

| Growth Correlation 3m | 5% |

| CAGR 5y | 17.15% |

| Sharpe Ratio 12m | -0.35 |

| Alpha vs SP500 12m | -31.22 |

| Beta vs SP500 5y weekly | 0.93 |

| ValueRay RSI | 99.20 |

| Volatility GJR Garch 1y | 30.02% |

| Price / SMA 50 | 16.76% |

| Price / SMA 200 | 26.95% |

| Current Volume | 4330.8k |

| Average Volume 20d | 1269.5k |

External Links for RMD Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of April 27, 2024, the stock is trading at USD 218.06 with a total of 4,330,840 shares traded.

Over the past week, the price has changed by +21.92%, over one month by +12.30%, over three months by +14.97% and over the past year by -1.61%.

According to ValueRays Forecast Model, RMD ResMed will be worth about 227.1 in April 2025. The stock is currently trading at 218.06. This means that the stock has a potential upside of +4.12%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 202.7 | -7.05 |

| Analysts Target Price | 184 | -15.6 |

| ValueRay Target Price | 227.1 | 4.12 |