The History of Novo Nordisk A/S

Novo Nordisk A/S, a global healthcare company, has its roots firmly planted in Denmark. Born from the merger of two Danish companies, Novo Terapeutisk Laboratorium and Nordisk Insulinlaboratorium in 1989, its legacy dates back to the early 20th century, focusing on diabetes care. An enduring commitment to innovation and care has guided its journey, evolving from providing insulin to offering a wide range of healthcare solutions.

Core Business

At its core, Novo Nordisk is dedicated to defeating diabetes. Its broad portfolio of insulin products and diabetes care technologies stands testament to this mission. The company leads in diabetic care, investing heavily in research and development to bring forward new treatment options and insulin analogues to improve the quality of life for people with diabetes.

Side Business Ventures

Beyond diabetes care, Novo Nordisk has diversified into other areas of healthcare. This includes haemophilia treatments, growth hormone therapy, and weight management solutions. Each of these sectors represents a strategic expansion, leveraging their extensive knowledge in biopharmaceuticals to address complex health issues, aiming for a holistic approach to healthcare.

Current Market Status

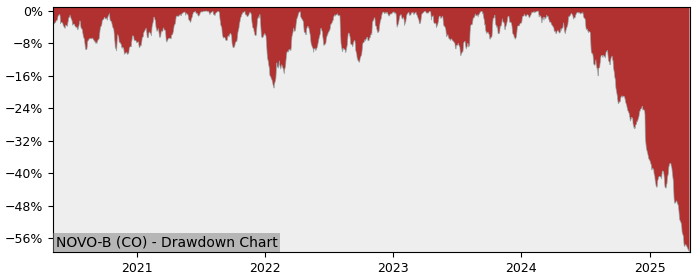

Today, Novo Nordisk A/S (CO:NOVO-B) maintains a strong presence in the global healthcare market. Its continued focus on innovation, along with a growing demand for diabetes care and obesity treatments, positions the company favorably. Despite the inherent challenges in the sector, including regulatory hurdles and market competition, Novo Nordisk's dedication to addressing chronic diseases keeps it at the forefront of the industry. The company's stock reflects its robust financial health and the trust investors place in its mission and strategic direction.