Vontier (VNT) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US9288811014

Vontier Corporation, listed on NYSE as VNT, is a global provider of mobility ecosystem solutions. These solutions are divided into three core segments - Mobility Technologies, Repair Solutions, and Environmental and Fueling Solutions.

The Mobility Technologies segment focuses on digital equipment solutions for the mobility ecosystem, offering products like point-of-sale systems, payment systems, telematics, data analytics, and software platforms, including solutions for alternative fuel dispensing. This segment plays a crucial role in enhancing the efficiency and effectiveness of various mobility operations.

The Repair Solutions segment specializes in manufacturing and distributing vehicle repair tools, toolboxes, automotive diagnostic equipment, and software through a widespread mobile franchise network. This segment caters to the needs of vehicle repair businesses, ensuring they have the necessary tools to maintain and repair vehicles effectively.

Lastly, the Environmental and Fueling Solutions segment provides hardware, software, and aftermarket solutions for fueling infrastructures, including environmental sensors, fueling equipment, payment hardware, software solutions for EV charging, vehicle tracking and fleet management, among others. This segment offers comprehensive solutions to support sustainable and efficient fueling practices.

With a diverse range of products and services, Vontier targets customers in various industries, including retail and commercial fueling, convenience store, car wash operators, commercial vehicle repair businesses, fleet owners/operators, and electric vehicle charging network operators. The company caters to customers across different regions, including North America, the Asia Pacific, Europe, and Latin America.

Established in 2019, Vontier Corporation is headquartered in Raleigh, North Carolina. To learn more about their offerings, you can visit their website at https://www.vontier.com.

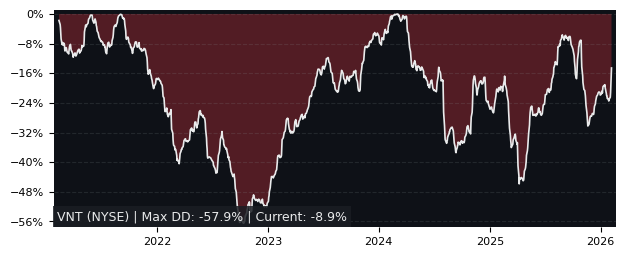

Drawdown (Underwater) Chart

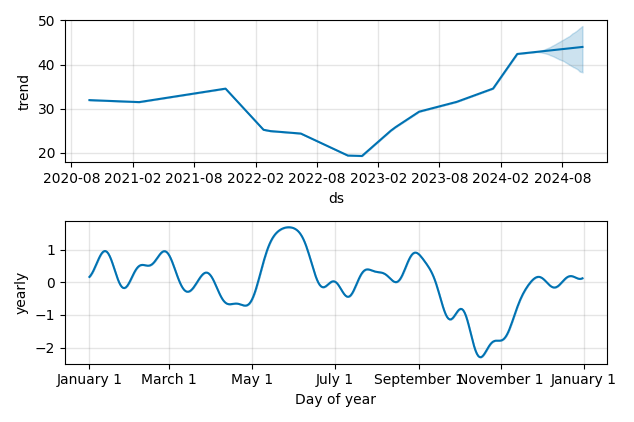

Overall Trend and Yearly Seasonality

VNT Stock Overview

| Market Cap in USD | 6,240m |

| Sector | Technology |

| Industry | Scientific & Technical Instruments |

| GiC SubIndustry | Electronic Equipment & Instruments |

| TER | 0.00% |

| IPO / Inception | 2020-10-09 |

VNT Stock Ratings

| Growth 5y | 1.98 |

| Fundamental | 48.8 |

| Dividend | 3.85 |

| Rel. Performance vs Sector | 0.84 |

| Analysts | 3.82/5 |

| Fair Price Momentum | 38.31 USD |

| Fair Price DCF | 72.14 USD |

VNT Dividends

| Yield 12m | 0.25% |

| Yield on Cost 5y | 0.30% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 99.3% |

VNT Growth Ratios

| Growth 12m | 42.34% |

| Growth Correlation 12m | 68% |

| Growth Correlation 3m | 7% |

| CAGR 5y | 4.49% |

| Sharpe Ratio 12m | 1.63 |

| Alpha vs SP500 12m | 19.58 |

| Beta vs SP500 5y weekly | 0.86 |

| ValueRay RSI | 6.49 |

| Volatility GJR Garch 1y | 24.57% |

| Price / SMA 50 | -7.33% |

| Price / SMA 200 | 12.43% |

| Current Volume | 746.1k |

| Average Volume 20d | 622.4k |

External Links for VNT Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 06, 2024, the stock is trading at USD 39.44 with a total of 746,097 shares traded.

Over the past week, the price has changed by -5.01%, over one month by -8.47%, over three months by +9.31% and over the past year by +42.34%.

According to ValueRays Forecast Model, VNT Vontier will be worth about 41.7 in May 2025. The stock is currently trading at 39.44. This means that the stock has a potential upside of +5.78%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 45.6 | 15.5 |

| Analysts Target Price | 33.8 | -14.4 |

| ValueRay Target Price | 41.7 | 5.78 |