Sonic Automotive (SAH) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US83545G1022

Sonic Automotive, Inc. is a prominent automotive retailer operating in the United States. Since its inception in 1997, the company has been delivering exceptional services to its customers from its headquarters in Charlotte, North Carolina.

The company is divided into three main segments - Franchised Dealerships, EchoPark, and Powersports. The Franchised Dealerships segment focuses on selling new and used cars, offering maintenance services, warranty repairs, and aftermarket products. Additionally, it provides financing, insurance, and extended warranties to enhance customer experience.

In contrast, the EchoPark segment specializes in selling used cars and light trucks. It also facilitates finance and insurance product sales, ensuring a seamless process for customers at its pre-owned vehicle retail locations.

Lastly, the Powersports Segment is dedicated to selling new and used powersports vehicles, ranging from motorcycles to personal watercraft and all-terrain vehicles. It also provides finance and insurance services to cater to the diverse needs of its clientele.

For more information on Sonic Automotive, Inc. and its operations, you can visit their website at https://www.sonicautomotive.com.

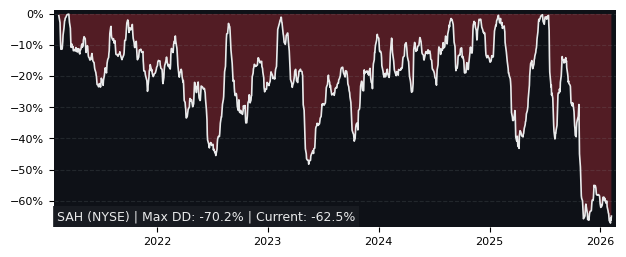

Drawdown (Underwater) Chart

Overall Trend and Yearly Seasonality

SAH Stock Overview

| Market Cap in USD | 2,124m |

| Sector | Consumer Cyclical |

| Industry | Auto & Truck Dealerships |

| GiC SubIndustry | Automotive Retail |

| TER | 0.00% |

| IPO / Inception | 1997-11-12 |

SAH Stock Ratings

| Growth 5y | 7.65 |

| Fundamental | 7.99 |

| Dividend | 8.27 |

| Rel. Performance vs Sector | 1.25 |

| Analysts | 2.43/5 |

| Fair Price Momentum | 60.91 USD |

| Fair Price DCF | - |

SAH Dividends

| Yield 12m | 2.09% |

| Yield on Cost 5y | 6.27% |

| Dividends CAGR 5y | 23.73% |

| Payout Consistency | 89.8% |

SAH Growth Ratios

| Growth 12m | 42.23% |

| Growth Correlation 12m | 51% |

| Growth Correlation 3m | 5% |

| CAGR 5y | 24.48% |

| Sharpe Ratio 12m | 0.87 |

| Alpha vs SP500 12m | 4.62 |

| Beta vs SP500 5y weekly | 1.58 |

| ValueRay RSI | 75.34 |

| Volatility GJR Garch 1y | 50.58% |

| Price / SMA 50 | 6.57% |

| Price / SMA 200 | 10.34% |

| Current Volume | 143.6k |

| Average Volume 20d | 287.7k |

External Links for SAH Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 07, 2024, the stock is trading at USD 56.43 with a total of 143,648 shares traded.

Over the past week, the price has changed by -6.53%, over one month by +6.96%, over three months by +12.03% and over the past year by +42.23%.

According to ValueRays Forecast Model, SAH Sonic Automotive will be worth about 65.8 in May 2025. The stock is currently trading at 56.43. This means that the stock has a potential upside of +16.57%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 53.8 | -4.61 |

| Analysts Target Price | 52.7 | -6.66 |

| ValueRay Target Price | 65.8 | 16.6 |