First Trust NASDAQ-100-Technology S.. (QTEC)

Exchange: USA Stocks • Country: USA • Currency: USD • Type: Etf • ISIN: US3373451026 • Technology

The First Trust NASDAQ-100-Technology Sector Index Fund, listed as NASDAQ:QTEC, primarily allocates a minimum of 90% of its assets (including investment borrowings) in the index's securities. The index, utilizing an equal-weighted approach, consists of technology-classified securities from the NASDAQ-100 Index® as per the Industry Classification Benchmark classification system.

For further information about the company, you can visit their official website at: http://www.ftportfolios.com/. The fund is based in the United States.

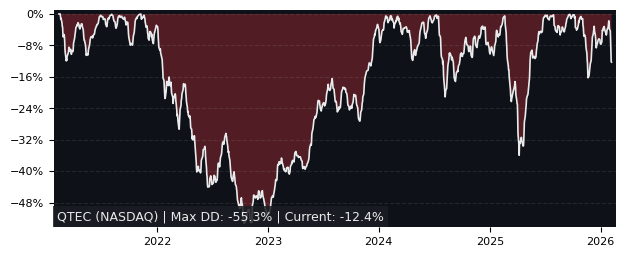

Drawdown (Underwater) Chart

QTEC ETF Overview

| Market Cap in USD | 3,661m |

| Category | Technology |

| TER | 0.57% |

| IPO / Inception | 2006-04-19 |

QTEC ETF Ratings

| Growth 5y | 6.38 |

| Fundamental | - |

| Dividend | 1.99 |

| Rel. Performance vs Sector | 0.94 |

| Analysts | - |

| Fair Price Momentum | 184.30 USD |

| Fair Price DCF | - |

QTEC Dividends

| Yield 12m | 0.07% |

| Yield on Cost 5y | 0.15% |

| Dividends CAGR 5y | -18.92% |

| Payout Consistency | 89.0% |

QTEC Growth Ratios

| Growth 12m | 48.87% |

| Growth Correlation 12m | 69% |

| Growth Correlation 3m | -25% |

| CAGR 5y | 16.02% |

| Sharpe Ratio 12m | 1.94 |

| Alpha vs SP500 12m | 17.71 |

| Beta vs SP500 5y weekly | 1.27 |

| ValueRay RSI | 30.88 |

| Volatility GJR Garch 1y | 26.93% |

| Price / SMA 50 | -2.28% |

| Price / SMA 200 | 9.98% |

| Current Volume | 106.1k |

| Average Volume 20d | 107.2k |

External Links for QTEC ETF

News

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

What is the price of QTEC stocks?

As of May 07, 2024, the stock is trading at USD 182.75 with a total of 106,139 shares traded.

Over the past week, the price has changed by +0.69%, over one month by -1.91%, over three months by +1.46% and over the past year by +50.77%.

As of May 07, 2024, the stock is trading at USD 182.75 with a total of 106,139 shares traded.

Over the past week, the price has changed by +0.69%, over one month by -1.91%, over three months by +1.46% and over the past year by +50.77%.

What is the forecast for QTEC stock price target?

According to ValueRays Forecast Model, QTEC First Trust NASDAQ-100-Technology S.. will be worth about 207.1 in May 2025. The stock is currently trading at 182.75. This means that the stock has a potential upside of +13.3%.

According to ValueRays Forecast Model, QTEC First Trust NASDAQ-100-Technology S.. will be worth about 207.1 in May 2025. The stock is currently trading at 182.75. This means that the stock has a potential upside of +13.3%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 207.1 | 13.3 |